The Goods and Services tax is the biggest indirect tax reform since 1947 and it has potential to lead the economic integration of India. This Monsoon session of Parliament might succeed in passing the GST Bill.

We hoped the GST Bill will be functional by April 1 this year, but it’s still stuck in the Rajya Sabha where the ruling government has no majority.

If the GST Bill is passed, there will be only one centralised tax that and will replace plethora of indirect taxes currently imposed. The GST Bill was proposed to streamline the process of taxation and to make it easier and more effective.

Finance Minister Arun Jaitley met with state finance ministers in Kolkata, and said that ‘virtually all states’ except Tamil Nadu have backed the proposed GST Bill. He urged PM Modi to meet Tamil Nadu CM Jayalalithaa and convince her to extend support for the bill.

PM Modi met Jayalalithaa yesterday for the first time post her election win. Tamil Nadu CM is of the opinion that in its present form, the GST Bill will affect the autonomy of the TN government

GST the game changer: GST will be a game changing reform for Indian economy by developing a common Indian market and reducing the cascading effect of tax on the cost of goods and services. It will impact the Tax Structure, Tax Incidence, Tax Computation, Tax Payment, Compliance, Credit Utilization and Reporting leading to a complete overhaul of the current indirect tax system.

GST will have a far reaching impact on almost all the aspects of the business operations in the country, for instance, pricing of products and services; supply chain optimization; IT, accounting and tax compliance systems.

GST would bring in significant change in doing business in India. Advocacy for best practices, gearing up for changes in processes, training teams and developing IT systems for being GST compliant are the key areas to be assessed.

What is the function of this Bill?

As Finance Minister Arun Jaitley puts it, the GST bill will lead to the economic integration of India.

The main function of the GST is to transform India into a uniform market by breaking the current fiscal barrier between states. Thus the GST will facilitate a uniform tax levied on goods and services across the country.

Currently, the indirect tax system in India is complicated with overlapping taxes levied by the Centre and the State separately.

Framework of the GST will replace indirect taxes

The GST will have a ‘dual’ structure, which means it will have two components- the Central GST and the State #GST. They will both have separate powers to legislate and administer their respective taxes. Thus equally empowering both.

Taxes such as excise duty, service, central sales tax, VAT ( value added tax), entry tax or octroi will all be subsumed by the GST under a single umbrella.

With passing of the GST bill, we can expect a climate of improved tax compliance.

Thus, the GST will basically have only three kinds of taxes, Central, State and another called the integrated GST to tackle inter-state transactions.

When is the proposed GST set to start functioning and what are the hurdles?

The GST regime is intended to be functional from 1st April, 2016.

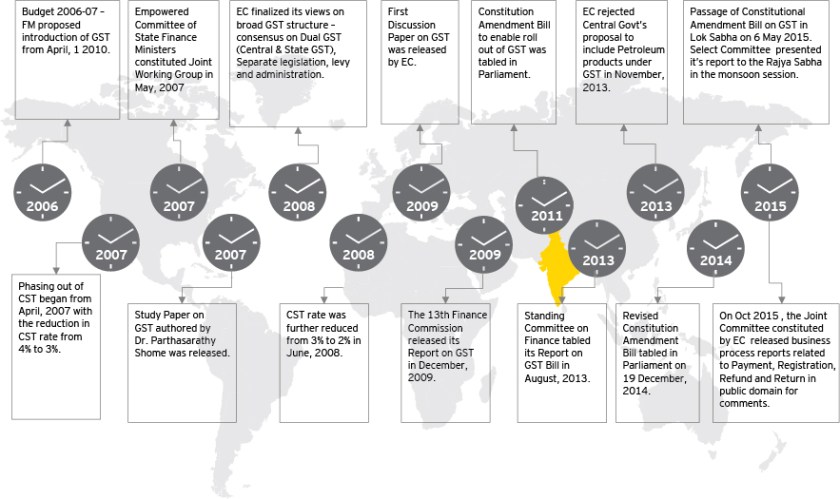

The first mention of the bill was in 2009 when the previous UPA government opened a discussion on it. They were successful in introducing the bill but failed to get it passed.

On December 17, 2014, the NDA government made slight changes to it and redefined it in the Lok Sabha. The bill got cleared on May 6 this year.

However the current challenge facing the bill is that it needs two-third majority of both houses and 50 percent of the state assemblies will have to ratify it.

The bill is now stuck in the Rajya Sabha, because the current government does not hold a majority here.

The role of the opposition

The Congress demands for reforms in key areas of the GST has been stalling the process of passing the bill.

Three main concerns of the Congress over the bill are:

-one per cent additional tax as goods move across states.

-the constitutional cap of 18 per cent and an independent dispute redressal mechanism.

-the party has maintained that the government was ignoring the concerns raised by the party on the legislation.

The impact and relevance of the GST bill

According to Finance Minister Arun Jaitlety the GST will be instrumental in helping the GDP of India to grow by 2 percent.

The GST also offers a solution to the multinationals as it breaks down the indirect tax structure into one single tax payable by the companies.

Although the states have feared loss of fiscal powers, the Constitutional amendment bill has promised to solve this by giving compensation packages for three years for any kind of revenue loss.

The bill has proposed to have GST council wherein all union and state minister in charge of finance will be on a equal footing. It will also have a Dispute Settlement authority to mitigate the tensions between the centre and state smoothly.

One main contention for the state in the GST is the inclusion of petroleum products. The current consensus on this is that the states will continue to levy sales tax/VAT on these with the exception of imports and inter-state trade.

Salient Features of proposed INDIAN GST System:

- The power to make laws in respect of supplies in the course of inter-State trade or commerce will be vested only in the Union government. States will have the right to levy GST on intra-State transactions including on services.

- Centre will levy IGST on inter-State supply of goods and services. Import of goods will be subject to basic customs duty and IGST.

- GST defined as any tax on supply of goods and services other than on alcohol for human consumption.

- Central taxes like, Central Excise duty, Additional Excise duty, Service tax, Additional Custom duty and Special Additional duty and State level taxes like, VAT or sales tax, Central Sales tax, Entertainment tax, Entry tax, Purchase tax, Luxury tax and Octroi will subsume in GST.

- Petroleum and petroleum products i.e. crude, high speed diesel, motor spirit, aviation turbine fuel and natural gas shall be subject to the GST on a date to be notified by the GST Council.

- 1% origin based additional tax to be levied on inter-State supply of goods will be non-creditable in GST chain. The revenue from this tax is to be assigned to the Origin State. This tax is proposed to be levied for initial two years or such period as recommended by the GST Council.

- Provision for removing imposition of entry tax / Octroi across India.

- Entertainment tax, imposed by States on movie, theatre, etc will be subsumed in GST, but taxes on entertainment at panchayat, municipality or district level to continue.

- GST may be levied on the sale of newspapers and advertisements and this would give the government’s access to substantial incremental revenues.

- Stamp duties, typically imposed on legal agreements by the state, will continue to be levied by the States.

- Administration of GST will be the responsibility of the GST Council, which will be the apex policy making body for GST. Members of GST Council comprised of the Central and State ministers in charge of the finance portfolio.

Understanding of GST

- GST is a value added tax, levied at all points in the supply chain with credit allowed for any tax paid on inputs acquired for use in making the supply. It would apply to both goods and services in a comprehensive manner with exemptions restricted to a minimum.

- In keeping with the federal structure of India, it is proposed that GST be levied concurrently by the Centre (CGST) and the States (SGST). It is expected that the base and other essential design features would be common between CGST and SGST, across SGSTs for the individual States. Both CGST and SGST would be levied on the basis of the destination principle. Thus, exports would be zero-rated, and imports would attract the tax in the same manner as domestic goods and services. Inter-State supplies within India would attract an Integrated GST (aggregate of CGST and the SGST of the destination State).

- In addition to the IGST, in respect of supply of goods, an additional tax of up to 1% has been proposed to be levied by the Centre. The revenue from this tax is to be assigned to the origin states. This tax is proposed to be levied for initial two years or such longer period as recommended by the GST Council.

Benefits of GST

GST has been envisaged as a more efficient tax system, neutral in its application and distributionally attractive. The advantages of GST are:

- Wider tax base, necessary for lowering the tax rates and eliminating classification disputes

- Elimination of multiplicity of taxes and their cascading effects

- Rationalization of tax structure and simplification of compliance procedures

- Harmonization of center and State tax administrations, which would reduce duplication and compliance costs

- Automation of compliance procedures to reduce errors and increase efficiency

Destination principle

The GST structure would follow the destination principle. Accordingly, imports would be subject to GST, while exports would be zero-rated. In the case of inter-State transactions within India, the State tax would apply in the State of destination as opposed to that of origin.

Taxes to be subsumed

GST would replace most indirect taxes currently in place such as:

| Central Taxes | State Taxes |

| · Central Excise Duty [including additional excise duties, excise duty under the Medicinal and Toilet Preparations (Excise Duties) Act, 1955]

· Service tax · Additional Customs Duty (CVD) · Special Additional Duty of Customs (SAD) · Central Sales Tax ( levied by the Centre and collected by the States) Central surcharges and cesses ( relating to supply of goods and services) |

· Value Added Tax

· Octroi and Entry Tax · Purchase Tax · Luxury Tax · Taxes on lottery, betting & gambling · State cesses and surcharges · Entertainment tax (other than the tax levied by the local bodies) Central Sales Tax ( levied by the Centre and collected by the States) |