Description

Unit Linked Insurance Plans refer to Unit Linked Insurance Plans offered by insurance companies. These plans allow investors to direct part of their premiums into different types of funds (equity, debt, money market, hybrid etc.). Where as

A mutual fund pools the money from investors and uses it to invest in various securities according to a pre-specified investment objective. Both unit Linked Insurance Plans and Mutual Funds expose investors to market risks.

Objective

Unit Linked Insurance Plans are long term plans offering you a dual benefit of insurance and investment. Where as Mutual funds are ideal investment tool for the short to medium term.

Regulatory

ULIP is regulated by Insurance Regulatory and Development Authority (IRDA) Where as Mutual funds are regulated by Securities and Exchange Board of India (SEBI).

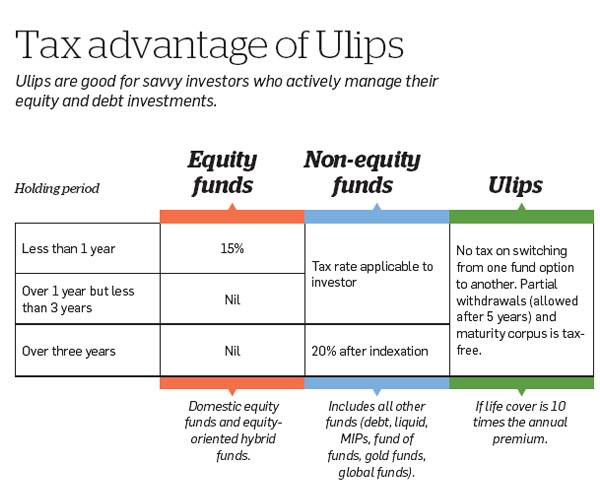

Tax Benefits

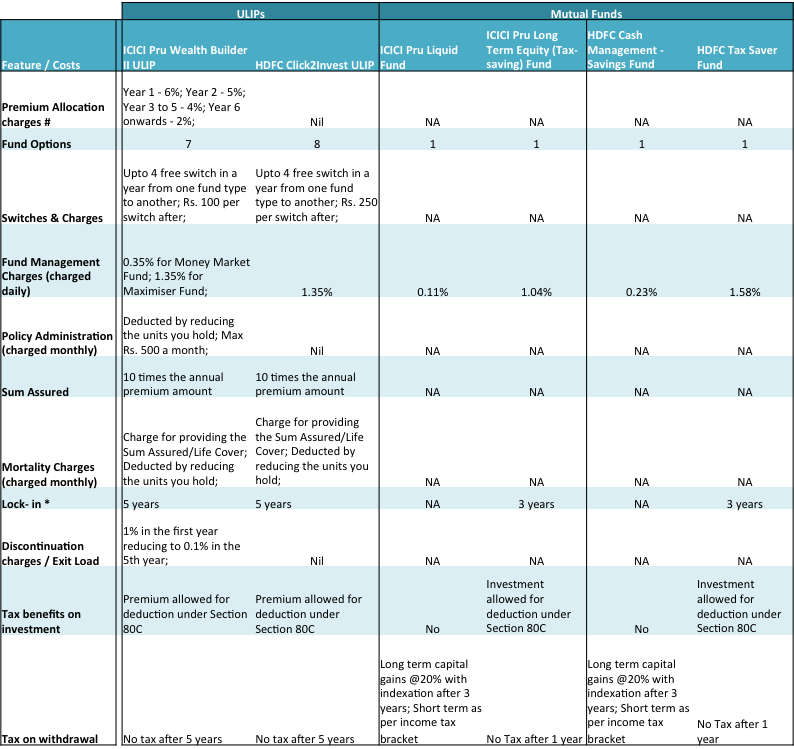

All Unit Linked Plans offer tax benefits under section 80C. While in Mutual Funds, only investments in tax saving funds are eligible for section 80C benefits.

Switching

Unit Linked Plans allows you to switch your investment between the funds linked to the plan. This enables you to change the risk return. But in Mutual Funds, no switching option is available. If you are not satisfied with the performance of the fund you can exit completely from the same by paying exit charges, if applicable.

Additional Benefits

Some of the Unit Linked Plans give you an additional benefit or loyalty benefit by issuing extra fund units. But there are no additional benefits issued by mutual funds.

Potentials of returns

Since ULIPs invest in relatively low risk products, the potential of returns is also low. The reason is that they have to promise sum assured irrespective of whether the plan makes money. Mutual funds are of different varieties. Equity oriented mutual funds give higher returns than the hybrid ones. Hybrid mutual funds offer better returns than debt funds.

Liquidity and Lock in

Unit Linked Plans have limited liquidity. One needs to stay invested for a minimum period of time as specified in the policy (lock period minimum 3-5 years) before redeeming the units. Where as you can easily sell mutual fund units (except for Equity Linked Savings Scheme and funds that have a minimum lock-in period).

Money utilization

The premium payments towards ULIP go towards the expenses, insurance Cover and equity mutual funds, where as the premium payments towards mutual funds goes towards the expenses and towards the stocks.

Charges

Charges in a unit linked plan include mortality charges for the life insurance provided. In addition, premium allocation charge, fund management charge and administration charges are applicable. Where as mutual fund charges include an entry load, the annual fund management charge and an exit load, if applicable.

Conclusion

ULIPs and Mutual funds offer a variety of products based on risk profile. Investors should understand their risk profile and investment period and then decide accordingly. If an investor has low risk profile and an investment horizon of 3 years, investing in ULIPs or mutual funds with major portion in equity is not a good idea. Similarly an investor with longer investment horizon and high risk appetite should go for equity oriented mutual fund or ULIPs with bigger exposure to equities.

ULIPs and mutual funds both have their benefits, and comparing them is like comparing apples and oranges. But it is important as an investor to consider that ULIPs are long term plans. As a product, ULIP have evolved with time, they much better than they were in their earlier edition.

If liquidity is the main concern then it is better to go for mutual funds without lock in period. But ULIPs offer an additional option to switch funds to enhance or protect the fund value. They come with lower costs and lesser risks in the long run.

Contributed By ::

B Sridhara Subudhi